november child tax credit amount

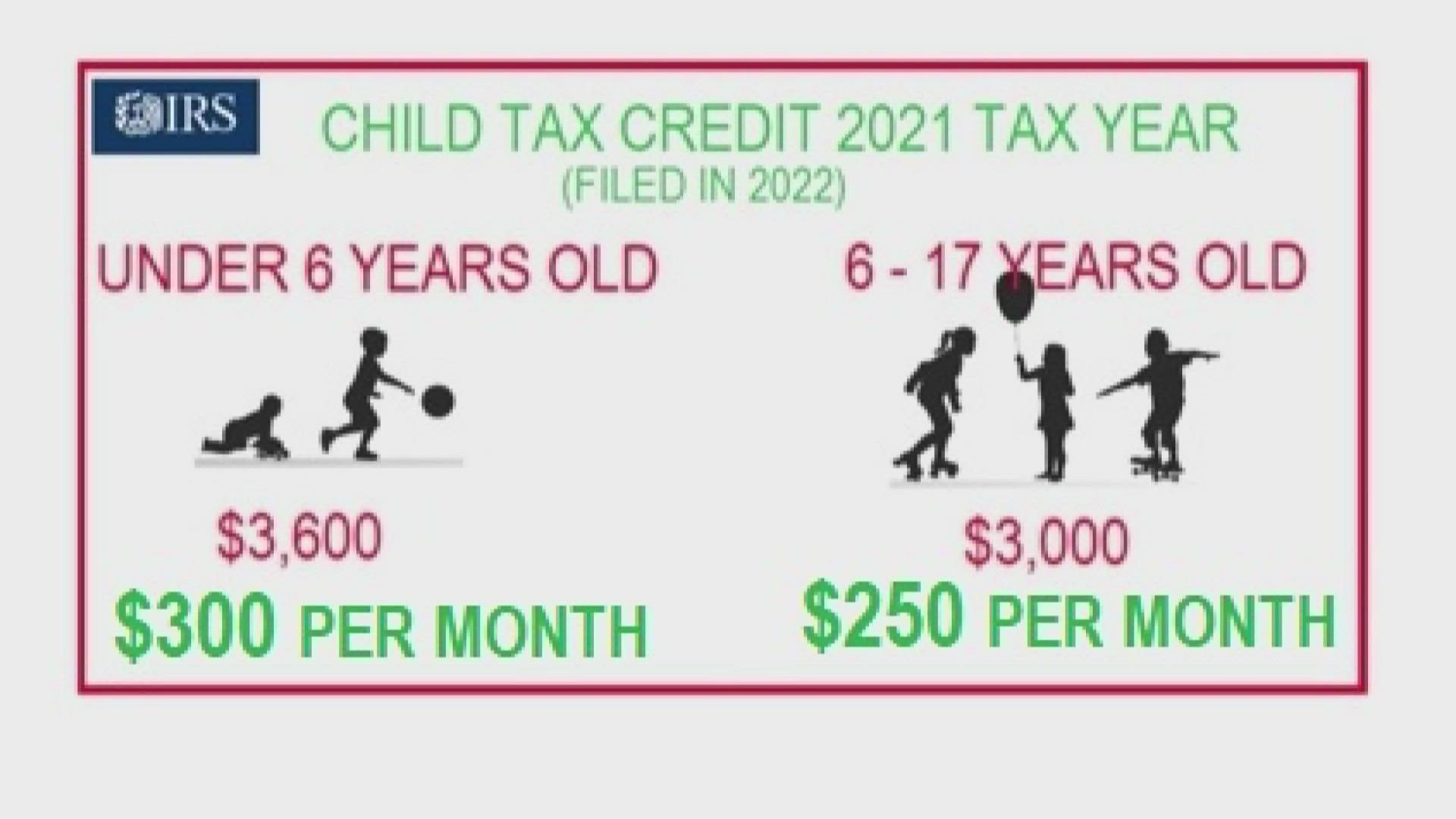

The full expanded child tax credit amount is 3000 for each qualifying child between ages 6 and 17 at the end of the 2021 tax year and 3600 for each qualifying child 5. Through the 2021 Enhanced Child Tax Credit families were able to receive 3600 for children under 6 years of age and up to 3000 for children between ages 6 to 17.

Child Tax Credit Did Not Come Today Issue Delaying Some Payments Kare11 Com

1 day agoT he American Rescue Plan allowed for an increase in the Child Tax Credit f or the 2021 tax year.

. The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from 2000 to 3600 for children under the age of. Liability by the amount of the child tax credit. For each qualifying child age 5 and younger up to 1800 half the total will come in six 300 monthly payments this year.

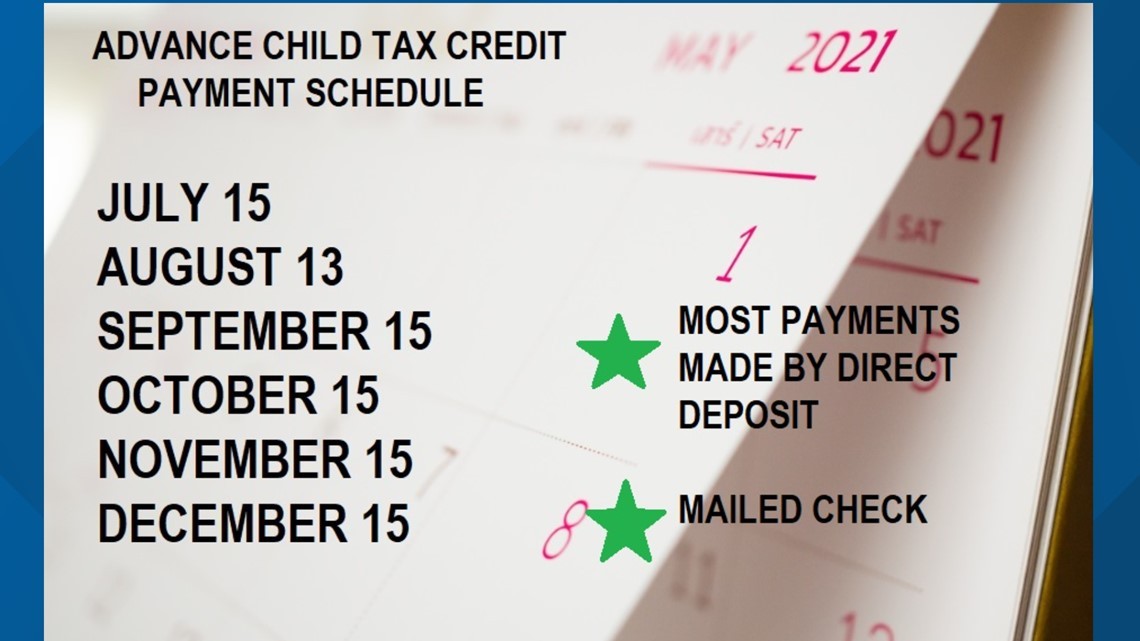

If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. For each kid between the ages of 6 and 17 up to. THE child tax credit program continues with another payment set to be issued next weekAs part of President Joe Bidens American Rescue Plan qualif.

The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17Eligible families who did not opt-out of the monthly payments will receive 300 monthly. An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit. Illinois 183 billion relief package includes income and property tax rebates that should be going out through November.

In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of. IR-2021-211 October 29 2021 On Monday November 1 the Internal Revenue Service will launch a new feature allowing any family receiving monthly Child Tax Credit. Individuals who earned less than.

Liability by the amount of the child tax credit. 4 2022 CNW Telbec - The first of the Government of Canadas new financial support measures will take effect this Friday November 4 2022 with the. The IRS has confirmed that theyll soon allow.

Have been a US. The maximum child tax credit amount will decrease in 2022. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive.

The maximum amount of the child tax credit per qualifying child. A childs age determines the amount. Those who miss the deadline can still claim the credit of up to 3600 per child if they file a 2021 tax return next year.

OTTAWA ON Nov. Your check amount will be based on your 2021 Empire State child credit your New York State earned income credit or noncustodial parent earned income credit or both. For 2021 eligible parents or guardians.

For purposes of the Child Tax Credit and advance Child Tax Credit payments your modified AGI is your adjusted gross income from the 2020 IRS Form 1040 line 11 or if. If you have not yet claimed the benefit on your taxes you may be entitled to. Here are some numbers to know before claiming the child tax credit or the credit for other dependents.

Currently eligible families that claim the child tax credit can subtract up to 2000 per qualifying child from their federal income tax liability. The enhanced child tax credit which was created as part. Currently eligible families that claim the child tax credit can subtract up to 2000 per qualifying child from their federal income tax.

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors.

What To Know About The First Advance Child Tax Credit Payment

When Is My November Child Tax Credit Coming Irs Payments Wtsp Com

Child Tax Credit Delayed How To Track Your November Payment Marca

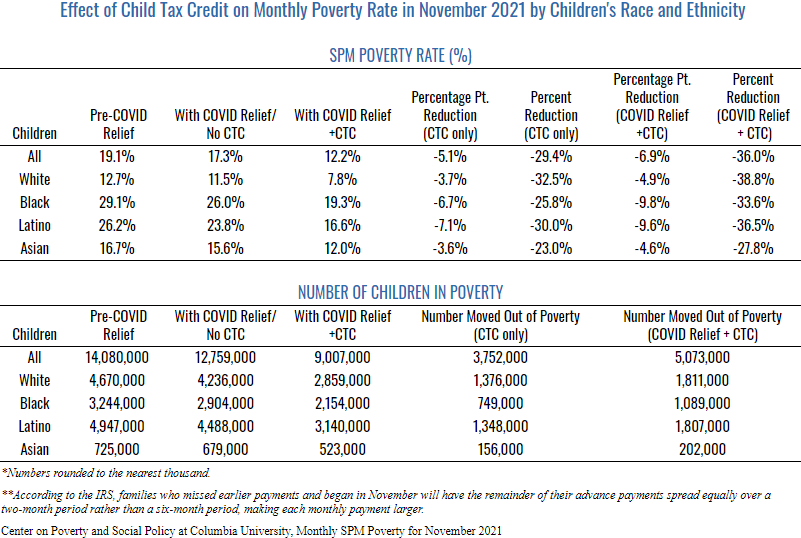

November Child Tax Credit Payment Kept 3 8 Million Children From Poverty Columbia University Center On Poverty And Social Policy

Parents Have Just Hours To Opt Out Or Make Changes To Child Tax Credits Or Face Paying Back The Irs Next Year The Us Sun

One Week Until November Child Tax Credits Are Paid Out What Time You Ll Get Them Explained The Us Sun

Irs Gives Taxpayers One Day To Rightsize Child Tax Credit November Payments November 1

Stimulus Update Some Child Tax Credit Payments May Be Lower In October November And December Al Com

Child Tax Credit When Will Your November Payment Come Cbs Baltimore

November 15 2021 Deadline For Non Tax Filing Families To Use Child Tax Credit Portal Lone Star Legal Aid

All You Need To Know About The New Child Tax Credit Change

November Checks Are In The Mail Child Tax Credit Youtube

Final Child Tax Credit Payment Opt Out Deadline Is November 29 Kiplinger

Child Tax Credit Update November 15 Sign Up Deadline Marca

The Final Child Tax Credit Payment Of 2021 Is Here Is It The Last One Ever Here S What Happens Next Marketwatch

Claim The Child Tax Credit By November 15 Seiu Local 73

Dependent Children 2021 Tax Credit Jnba Financial Advisors

I Got My Refund Https Www Irs Gov Newsroom Irs Updates 2021 Child Tax Credit And Advance Child Tax Credit Payments Frequently Asked Questions Facebook

Child Tax Credit 2021 8 Things You Need To Know District Capital